Sale Taxes

taxes

Overview

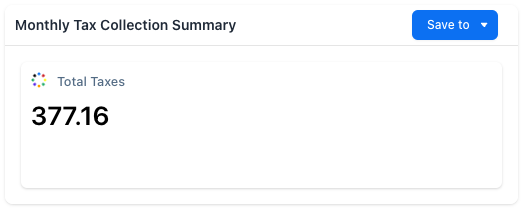

Sale Taxes refers the total amount customers paid in taxes, before adjusting for refunded taxes.

Sale Taxes = Total taxes paid by customers, before refunds

The calculation is based on data from the Orders table.

Insights and Actions

- Optimize Cash Flow: Use tax collection data to manage cash flow more effectively, ensuring funds are allocated for tax obligations without disrupting operational liquidity.

- Strategic Pricing: Analyze tax data to adjust product pricing strategies across different regions to remain competitive while covering tax costs.

- Tax Liability Forecasting: Leverage detailed tax data to forecast future liabilities, helping in financial planning and avoiding fiscal surprises at tax time.

Example Use

Prompt

What is the total amount of taxes collected over the past month?

Response

Query

SELECT

SUM(ot.taxes) AS sale_taxes

FROM

orders_table AS ot

WHERE

ot.event_date BETWEEN toStartOfMonth (CURRENT_DATE()) - INTERVAL 1 MONTH AND toStartOfMonth (CURRENT_DATE()) - 1;Updated 6 months ago